February 24

Stocks and yields are going down. The DOW is down over 700 points to start off the week.

The coronavirus is starting to spread outside of China which is very scary for economic trading.

We are expecting to soon experience the lowest interest rates we have ever seen.

February 25

Interest rates remain at some of the lowest ever in the market.

Today’s downturn of the stock market shows a big opportunity for the bond market in coming weeks.

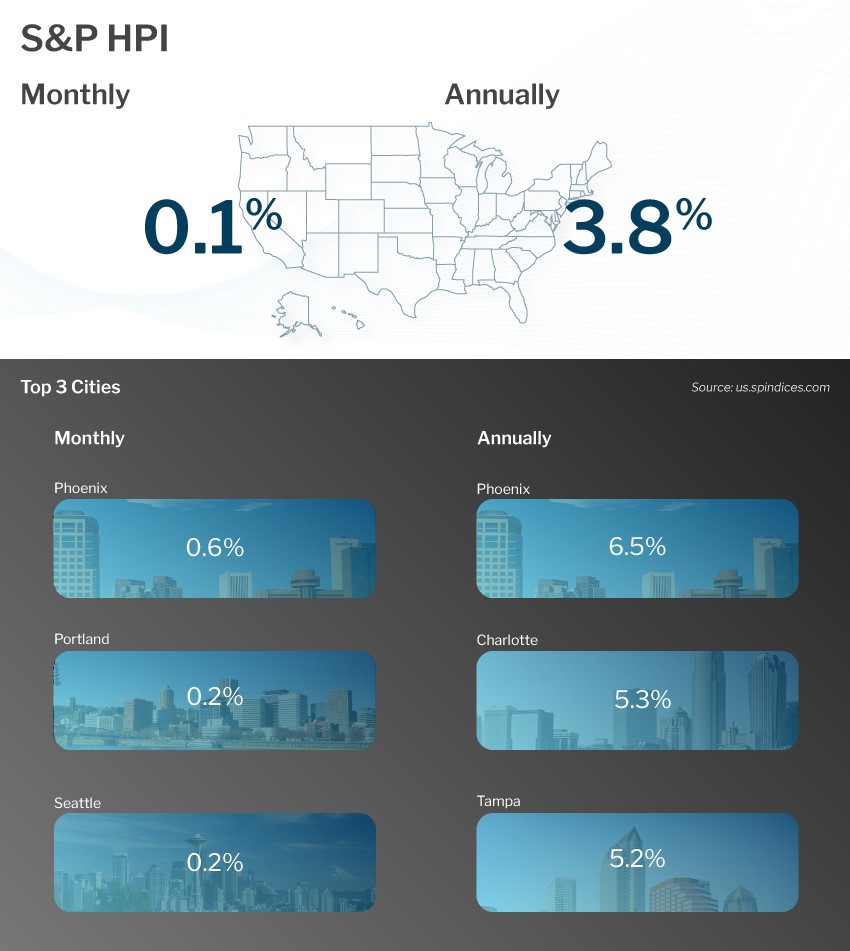

The Case-Shiller Home Price index was released; showing a 3.8% gain in the national index for the month of December. This is up 1% from November.

February 26

New home sales were up 8% in January which was a lot stronger than expected.

Sales are up 19% year over year.

An estimate of new homes for sale at the end of January was at an astounding 324K. This is a supply of 5.1 months at the current sales rate.

February 27

Stocks hit the floor today from even more spread of the coronavirus.

Initial jobless claims went up from 211K to 219K.

Pending home sales for January up 5.2% and up 5.7% year over year.

February 28

The coronavirus has had a very negative impact on stock market.

We would have gotten these low mortgage bond rates regardless of what happened.

The stock market and GDP will both continue to decrease as more cases come out.