A 2-1 buydown (pronounced “two one buydown”) is a feature for residential mortgages where the monthly payments for the first two years are based on temporary reductions in the mortgage interest rate. Check out our rate buydown options and calculator.

Often home buyers use this feature when purchasing a newly constructed home from a home builder and find it on various mortgage programs. Home builders often provide financial incentives that cover the costs of the 2-1 temporary buydown and other new construction closing costs.

What is a 2-1 Buydown

A 2-1 buydown allows the home owner to pay lower monthly principal and interest (P&I) payments for the first two years of their home loan. The reason this is possible is because the seller (i.e. the home builder) prepays mortgage interest at closing on behalf of the buyer.

Technically the mortgage interest rate does not change with a 2-1 buydown. What changes is the homeowner’s monthly obligation for the first two years of the loan.

The seller is paying the difference between the interest paid by the homeowner and the interest that due using the actual interest rate. This cost will shown as mortgage points that are accompanied by a seller concession. (There is an example below showing more details).

The “2” in the 2-1 buydown means that the first-year’s payments are based on an interest rate that is two percent (2%) below the actual rate. That “teaser rate” is only for the first year of the loan.

The interest rate during the second year is one percentage (1%) lower than the actual rate. That is the “1” in 2-1 buydown.

This means that the full principal and interest (P&I) monthly mortgage payment won’t be based on the actual, permanent interest rate until year three.

Temporary 2-1 Buydown vs. Permanent Rate Buydown

A 2-1 buydown temporarily lowers the monthly principal and interest (P&I) payments. This is different than permanently buying down the interest rate.

Permanently buying down the interest rate means that discount points are paid at closing to permanently reduce the interest rate. This obviously reduces the amount of interest paid over the life of the loan.

By contrast, a 2-1 buydown does not reduce the interest paid; instead, it allows the seller to prepay interest on the buyer’s behalf at closing. The mortgage servicer still receives payment of the amount due for the actual interest rate.

Qualifying for a 2-1 Buydown

When applying for a mortgage with the 2-1 buydown feature, the future homeowner will need to qualify using the full payment based on the actual interest rate, not the temporarily reduced rate.

The temporarily lower payments for the first two years do not make mortgage underwriting easier. The borrower must use their qualifying income to receive approval on the potential full payment.

These are not “risky” loans like those from the past because the borrower’s must be able to qualify for the full payment before ever closing on the loan. Moreover, the homeowner knows exactly what the future payments will be before closing on the loan.

When Does a 2-1 Buydown Makes Sense?

A 2-1 buydown temporarily reduces the monthly mortgage payment obligation. There are a variety of reasons home buyers welcome this temporary relief.

Below are a few examples of when a 2-1 buydown may make sense for a home buyer:

- when future income is expected to increase,

- when short-term expenses can soon be reduced,

- when mortgage interest rates have risen dramatically and are projected to decrease in the future.

Future income is expected to increase

The 2-1 buydown allows homeowner the flexibility to “grow” in to their mortgage payments. Often times this can be for young professionals with upward income growth, or for new employment positions that offer future incentives.

For example, Joe Buyer recently started a new sales job. He has a base income and will receive commission when he sells widgets. Joe Buyers expects his commission to increase as he builds his pipeline of customers in the coming years.

A 2-1 buydown makes great sense for Joe Buyer because the temporarily lower payments alleviate undue stress while his income grows.

Future reduction of expenses

There’s often a welcome for temporary 2-1 buydown payments when there are other financial obligations the home buyer will soon pay off and eliminate.

For example, if Joe Buyer has a student loan with a $500 per month obligation that he will pay off in two years, the buydown will allow the flexibility for Joe to focus on that debt and eliminate it during the first couple of years during homeownership.

Another reason there may be a welcome for 2-1 buydown payments is because of the short-term financial obligations that come with a new home. The cost of moving, new furniture, and home décor can certainly impact the monthly budget during the first year of homeownership. The 2-1 buydown’s monthly payments provide some relief.

Potential refinance with lower rates

There are future instances where experts project interest rates to decline.When inflation is high and the Fed is raising rates, mortgage interest rates typically run high as well. Later, after the Fed finishes raising rates and inflation cools, mortgage interest rates typically decline.

A 2-1 buydown allows homeowners to pay lower monthly payments during a time when interest rates are higher than future projections. A temporary buydown affords homeowners the luxury of lower payments while waiting for rates to come down for a potential refinance.

This scenario doesn’t present itself often, but it’s relevant when it’s present.

“Refund” for Refinancing (within 2 years)

If the initial home loan is refinanced within the first two years, the unused amount of the 2-1 concessions will be applied towards principal at time of the refinance closing. In other words, the unused funds reduce the mortgage debt and act as a principal payment when the refinance closes.

The reason for this is because the seller concessions belong to the homebuyer. The seller concessions cover the gap between the 2-1-buy-down-temporary payment and future permanent payment. Therefore, if not all 24 months of temporary payments are made, there will be an excess of funds that remain. That amount is owed to the buyer if the purchase mortgage is paid off before 24 months.

2-1 Buydown Costs

The costs for a 2-1 buydown are based on the principal and interest (P&I) payments of the potential home loan. The two factors that determine the costs are the interest rate and loan amount.

Below is an example for Joe Buyer’s purchase and the cost for his 2-1 buydown. Please note that is an example. This is NOT based on current market interest rates OR the APR. In addition, this is NOT indicative of any loan options available. In other words, please use this only as an example and don’t get all “legal” of me.

As an FYI, we like using www.FreddieMac.com as a reference for current market rates. It’s not perfect – it only updates on Thursdays while rates update every single day (and sometimes multiple times a day). That said, it’s a good enough reference to use for example purposes.

2-1 Buydown Parameters

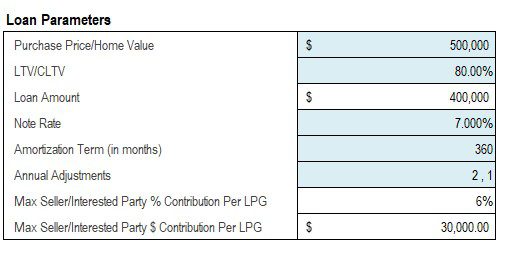

Joe Buyer is purchasing a newly constructed home from a home builder for $500,000. Joe will put down 20% for his down payment. The interest rate on his loan will be 7.0% before applying any concessions or credits. (See above picture).

The builder is offering Joe $10,000 of seller concessions. Joe is considering how to use these funds for his closing costs payment methods.

Rate and Payment Structure

When using a 2-1 temporary buydown the payment for the first year will be based on a 5% interest rate (7% – 2% = 5%). Therefore, Joe’s payments will be $2,147.29 for the first year instead of $2,661.21 that should be charged for a 7% interest rate. (See above picture.)

Joe’s first year of payments are $513.92 lower because of the 2-1 buydown. After 12 months the difference in interest paid between 5% and 7% is $6,167.08 ($513.92 x 12 months).

In year two the payments will be based off 6% (7% – 1% = 6%). In year two the P&I payments for a 6% rate rate will be $2,398.20 instead of the normal $2,661.21 at 7% interest.

Joe’s second year of payments are $263.01 lower because of the 2-1 buydown. After months 13 through 24, the difference in interest paid totals $3,156.09 ($263.01 x 12 months).

Buydown Costs

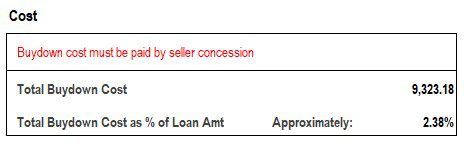

Over the first two year’s, Joe has “saved” $9,323.18 ($6,167 + $3,156) of interest. This amount is the total amount the seller has a requirement to pay at closing to secure the 2-1 buydown. (See above picture.)

Joe can apply $9,323 of the builder’s $10,000 of seller concessions toward the buydown. In addition, Joe can use the remaining incentives for other purposes.

Alternatives to a 2-1 Buydown

There are alternatives to using seller concessions for a temporary buydown. Concessions can be used to permanently buydown an interest rate, pay for closing costs and prepaids, or reduce the sales price of the home. Please see closing cost payment methods for more details on these options.