A homebuyer’s purchasing power is primarily determined by the debt-to-income ratio. The debt to income (DTI) for a home loan is calculated by taking the total monthly debt obligations and dividing that by the total gross monthly income.

The Mortgage Mark Team created a DTI calculator to help determine a buyer’s purchasing power. Below are detailed instructions and screen shots on how to use the worksheet.

Purchasing Power with DTI

The question of “how much home can I afford?” is determined by the DTI ratio. While other components – like the loan program, credit scores, and down payment – impact loan approval, the debt-to-income ratio determines a buyer’s purchasing power.

The tricky part of the debt-to-income formula is knowing what debts to count and what qualifying income to consider. Below are parameters on what to use when calculating DTI and determine how much home a buyer can afford.

DISCLAIMER: The debt-to-income calculator worksheet is not perfect. It’s intended to serve as a guide and a tool to help determine a buyer’s purchasing power.

DTI Requirements for Various Loan Programs

The mortgage loan program type and Loan To Value (LTV) will play a large part in determining how much home someone can afford. Different programs have different underwriting guidelines and DTI requirements.

Conforming loans typically have a 45% threshold for for DTI. Occasionally the automated underwriting systems will allow for a DTI ratio to be as much as 50% or 55%.

Government Loans (like FHA, VA, and USDA) can allow for higher DTI ratios with an automated approval from their respective underwriting systems.

Jumbo Loans are typically the most conservative and limit the debt-to-income ratio to 43%. The loan will become a non-qualified mortgage (non-QM) when the DTI surpasses 43% on a jumbo loan

It’s worth noting that the DTI ratios may be more restrictive when the subject property is for a non-primary home. Mortgages for vacation homes and investment properties will also have greater down payment requirements. These factors may reduce the purchase power for second homes and investment properties.

Higher DTI with Higher Credit Scores

Credit scores will impact how much home someone can afford because they impact the interest rate and mortgage insurance. Both the rate and MI impact the monthly mortgage payment, which is used to calculate the debt-to-income ratio and purchasing power.

Most loan programs require an approval from an automated underwriting system that evaluates the overall profile of a loan. These underwriting systems consider the credit, income, and assets when issuing loan approvals.

Higher credit scores translate to lower credit risk for lenders. Therefore, the automated underwriting systems may issue loan approvals for consumers with elevated DTI ratios if the buyer has higher credit.

Debt-To-Income Calculator Explained

A mortgage payment calculator helps estimate the home loan’s monthly payment. A debt-to-income calculator calculates the DTI ratio and determines the purchasing power.

The default settings in the DTI calculator are for primary homes in the DFW area. Various fields can be modified and are notated in blue.

Input Loan Terms

The first data points to enter in the DTI calculator are the sales price, down payment percentage, interest rate, and loan duration. A start date is needed, but the actual date is not important.

Check out our page on mortgage down payments to learn about the minimum down payments required for each loan program.

Interest Rate Input

Mortgage interest rates change daily and are determined by a number of parameters. The only way to truly know what an interest rate will be is to get pre-approved.

In the interim, an interest rate can be found at FreddieMac.com. Freddie Mac’s rates are only updated on Thursdays, but they are determine by actual loans in process. In other words, FreddieMac.com is not like other websites that show rates as an attempt to make the phone ring.

Freddie Mac’s website only shows interest rates associated with mortgage points. For a no point loan the interest rate may be .25% to .5% than what is shown (assuming that a no point option is available).

Freddie Mac only offers financing for conventional loans with conforming loan limits. Regardless, the the Freddie Mac interest rate can be used as a placeholder for the government loans (like FHA, VA, and USDA) since those rates aren’t published.

Enter Program, Occupancy, and HOA

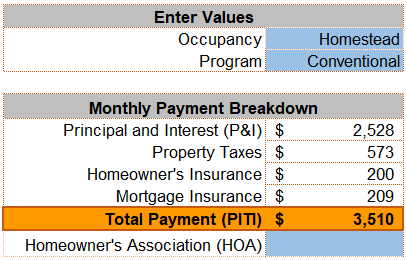

The next input is the occupancy, program, and monthly HOA dues.

For occupancy, “Homestead” means you plan on living in the home as your primary residence.

The default loan program is set to conventional financing.

Enter the mandatory HOA dues. While this amount is not included in the monthly payments, the HOA does need to be included for the DTI calculator.

Erroneous Inputs Show Red

The worksheet will show red error warnings if input isn’t correct. In the example below, FHA home loans are not allowed on investment properties. To remedy this error the “Occupancy” will need be changed to “Homestead” (or the loan program changed to “Conventional”).

Enter Property Taxes & Homeowner’s Insurance

Property taxes and home owner’s insurance are considered mortgage prepaids. The default rates are generic for the north Texas area. Edit these numbers as needed.

The debt-to-income calculator requires that these fields have a value; regardless if escrow are waived. Waiving escrows is only an option for conventional loans when the loan to value is 80% or lower. Conversely, all other loan programs (like FHA, VA, and USDA) require that taxes and insurance be paid as part of the mortgage payment.

The monthly MI factor will update automatically. For conventional loans, the MI rate is estimated using a 720 credit score. For other programs (like FHA and USDA), the MI factor is set based on the program’s guidelines.

Liabilities for DTI Calculations

The debt-to-income ratio is calculated by dividing the monthly debt obligations (including the potential new mortgage payment) by the gross monthly income.

If it’s a court-ordered debt then you have to count it. Examples for this include child support, alimony, IRS tax lien payments, etc. These items will not appear on a credit report so please disclose this to us up front.

Credit Card Minimums

The mortgage industry will use the debts on a credit report and count the minimal monthly obligation. For credit cards, the monthly statement show the minimum amount payable.

For example, if Joe has a $5,000 balance on a credit card and the monthly obligation is $100 per month, the mortgage industry will use the $100 even if Joe paying $500 to get it paid off quickly.

Student Loan Debt

Student loans that are in deferment still need a monthly payment for DTI calculations. The monthly payment amount is either determined by the student loan creditor or the mortgage loan program.

Ideally the student loan creditor can provide documentation for the future payment. If this is not available, the mortgage industry will require that a monthly payment be calculated based on the loan’s balance.

For government loans (like FHA, VA, and USDA), the monthly payment for the deferred student loan is calculated by taking 1% of the loan balance. For example: the mortgage industry will use a debt obligation of $300 monthly for a $30,000 student loan debt that is deferred.

For conventional loans, the monthly payment of the deferred student loan is calculated by taking .5% of the loan balance. A $30,000 deferred student loan would use a $150 per month obligation for the DTI calculator.

Debts to Exclude

Monthly debt obligations on a credit report need to be counted when calculating the debt to income. Conversely, normal living expenses do not need to be included in the DTI calculator.

The following living expenses do NOT need to be counted toward the loan’s DTI calculations:

- utility bills,

- cell phone bills,

- cable bills,

- tithes to the church,

- auto insurance,

- etc.

These items do not have to be included in the DTI calculations for qualifying as they do not appear on a credit report.

Other Debt Exclusions

Debts can be excluded if there is legal documentation that removes the financial obligation. For example, if a divorce decree awarded the borrower’s ex-spouse with the previous home (and mortgage), that debt obligation does not need to be counted in the DTI calculation.

There is a possibility that debts may be excluded if they are installment loans with only a few payments remaining. For example, a car loan with five months of payment left could be omitted. Typically debts with less than 10 months remaining may be excluded.

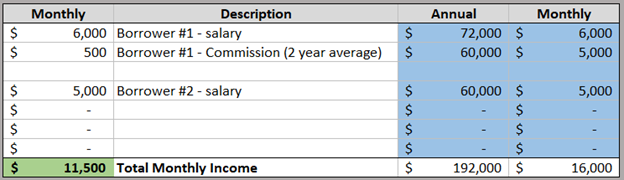

Income for DTI Calculation

For the “normal” salaried, W2 employee the income is simple: use the before-tax monthly income. The same goes for fixed income sources (like pensions, VA benefits, social security income, etc.).

The variable sources of income require greater scrutiny. Check out the qualifying income page to determine how to calculate other types of income for the DTI calculator.