A seller’s net sheet estimates how much money a seller makes from the sale of their home. We created a fancy Excel spreadsheet that estimates a seller’s closing costs.

Provide your information via the pop-up window (or the form in the middle of this article) and we will email you the worksheet. Please call the Mortgage Mark team if you have any questions or concerns. We’re here to help.

Seller’s Net Sheet Overview

A seller’s net sheet is typically provided by a Realtor or a title company. Our worksheet, however, provides greater detail than most other estimates. You’re welcome to edit cells highlighted in blue.

We defaulted various costs in the worksheet with estimated values for the sale of a home in Texas. Similarly, we put zeros for less common (fairly nominal) fees in the event you don’t know those figures. Cells left blank are values that you provide about your current home loan.

Thank you!

You have successfully joined our subscriber list.

Seller’s Closing Costs

When selling a home in Texas the seller will most likely be responsible for paying some of the buyer’s closing costs. The seller’s portion of the buyer’s costs typically consists of the title policy, a survey, and a home warranty.

The seller’s closing costs will be provided by the title company. The seller’s fees in Texas typically consist of:

- settlement closing fee for $300(ish),

- document prep fee for $250(ish),

- courier fee estimated at $40(ish),

- tax cert for $38(ish),

- recording fee for $40(ish),

- and a state guarantee fee for a whopping $2.

The total estimate for the seller’s closing costs is $670(ish). These seller’s closing costs are used in our seller’s net sheet worksheet.

Seller’s Net Sheet Assumptions

We are making a number of assumptions and including a various fees at the seller’s expense. These are typically and customary seller fees in Texas.

Title Policy

We are assuming that your contract will have you, the seller, paying for the buyer’s title policy. This is very common for existing home sales.

New construction sales, however, the responsibility of the title policy cost varies from builder to builder.

Property Survey

For worst-case purposes, we will assume that you don’t have a survey and that you will incur the costs for a new survey. If an survey exists then this cost can be eliminate so long as it’s accurate. You need to know why a mortgage lender won’t use your survey.

Home Warranty

We will assume that a home warranty will be paid by you, the seller, as this is fairly common. This costs can vary so feel free to update that amount in the calculator.

Amount Held in Current Escrow Account

Leave this section blank if you don’t have an existing escrow account. If you do have an escrow account with your current mortgage then you’re entitled to an escrow refund.

After closing the mortgage service will send you a refund (at your new address) for any unused funds that remain in your escrow account. This typically won’t arrive until 30-60 days after your closing.

Current Prepaids

The most confusing part about the seller net sheet are the HOA dues and per diem interest. Good news, these aren’t life-changing amounts.

Prepaid HOA Dues (rows 14 and 15): if you’re not sure about this then leave it blank as it’s typically not much money. The buyer will reimburse you for any prepaid HOA dues.

Per Diem Interest (row 20): mortgage payments are paid in arrears. This means the payments are due after the interest is accrued. In other words, when you make a normal mortgage payment, you’re paying for the previous month’s interest. Therefore, to determine your mortgage payoff you’ll need to add an estimated amount for per diem interest that will be added. The easy way, just add your monthly payment to this section.

Final Net After Closing

The seller’s net sheet includes a final net after closing amount. The day of closing and funding you’ll get money from the title company. What may not be included is a refund of your current escrow account (if you have one). Your current mortgage servicer will dictate when that refund is issued.

It’s possible that the mortgage servicer may net the escrow amount from the mortgage payoff. In other words, they may reduce the amount you owe them by the amount held in your escrow account.

The alternative is that they don’t net the escrows from your payoff. In this case they will mail you a check after closing for the amount held in your escrow account. This is typically done within 30 days.

What’s Next

Mark and the team can walk you through the entire home loan process and mortgage loan process. Call us with any questions and let us know how we can help.

Other Seller Related Articles

- Greatest fears when selling your home

- Questions to ask a lender about your buyers

- Questions to ask about your buyer’s lender

- Home inspections and appraisals: lender’s perspective

- Checklist for moving out of your home

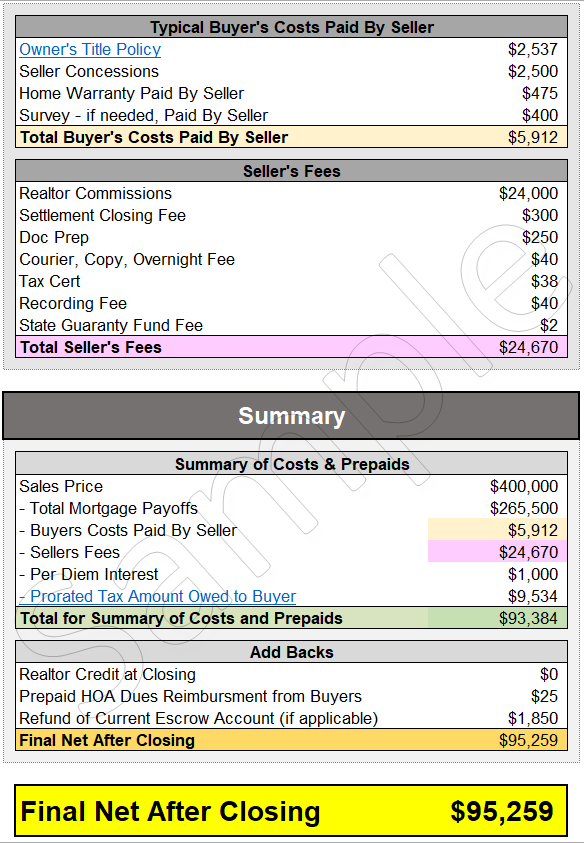

Sample Seller’s Net Sheet

Below is a screenshot of the seller’s net sheet that’s available in Excel. Submit your information and we’ll email you the form.