Chances are, you’re reading this because you’ve had (or expect to have) an appraised value come in lower than expected. The first thing we recommend is to check out appraised value vs. sales price: plan for the worst. There may be a remote chance where the low value won’t impact your financing and you may not need to fight a low appraisal.

We feel it necessary to remind everyone that the very vast majority of Appraisers are competent, hard-working professionals. They are trying to protect you from overpaying on a home. They do their best to provide the most accurate and unbiased information available. Remember that they are human which means they’re fallible and have feelings too.

The way to fight a low appraisal is with facts. The three steps in doing so are:

- evaluate and dismiss comps

- finding comp(s) to replace the removed properties,

- and provide a written explanation for why the comps should be switched.

We recommend you learn to avoid appraisal pitfalls if you’ve not had an appraisal done. A good defense is a good offense. Be proactive so that this article doesn’t pertain to you.

Appraisal Related Articles

- Home appraisal process (great overview of the process)

- Don’t pay for the appraisal too soon

- How appraised value is determined (hint: it’s not price per square foot)

- Avoid appraisal pitfalls

- Appraised value vs. sales price – how to prepare for the worst

- How to fight a low appraisal

Fight a Low Appraisal

An Appraiser’s job isn’t to tell us what one person will pay for the house, it’s to convey what “everyone” would pay for the house. Changing an appraised value is tough.

Realize that an Appraiser’s work is graded by the lender, the AMC, and the Texas Appraisers Licensing & Certification Board (TALCB). Adjusting the value higher is proof that something was initially incorrect. Conversely, Appraisers realize they need to adjust values if data supports an increase. Their obligation is to provide an accurate assessment of the property based on available data.

Don’t Do, Don’t Care

Let’s discuss what NOT to do when you fight a low appraisal.

First, don’t send a bunch of addresses with the price per square foot circled saying they’re better comps. We promise the Appraiser already has that data. You need to do the necessary due diligence required to request a reconsideration of value. See below for details.

Second, don’t focus on what was done to the home and how much it costs. The Appraiser visited the property and knows what’s there. Moreover, what was spent versus what was value-add are two different things. Find what upgrades are NOT in other comps and focus on that data.

Lastly, don’t be ignorant about how the appraisal value is determined. Realize that there must be recent, nearby comps for full adjustment amounts to be awarded. For example, having a one-acre lot is great but when comps are on .18 acres it becomes difficult to give much value to the oversized lot. It’s not good to be the big house on the street.

Evaluate and Dismiss Comps

The first action is to evaluate the comps used and determine if there are any “bad” comps or outliers. Then find new comps that weren’t used and see if they are better than what’s been provided.

For example: if comp #3 is 1.2 miles away from the subject property and the rest of the comps are within .5 miles then there’s a possibility that comp #3 can be dismissed. The challenge will be finding a comp that is closer but still shares the same characteristics of the house. More often than not the appraiser had to go farther to find another home like the subject property.

Characteristics to compare

Below are the most common characteristics to compare on the appraisal. Any large adjustments or outliers in these categories would be good starting points to challenge. It goes without saying that you only want to dismiss comps that hurt your cause. In other words, you want to throw out any “Adjusted Sales Price of Comparable” that is lower than your sales price.

- Distance (“Proximity to Subject”) – For city and suburbs the comps should be under a mile. Closer is better.

- Date of Sale – Ideally comps should all be sold within the last six months. The more recent the better. You can tell when the Appraiser is stretching to make value when the oldest sale is Comp #1.

- Lot size (“Site”) – Typically bigger is better but that does have exceptions. For example, the lot could be irregularly shaped with wasted space that doesn’t add much value. Or perhaps it backs up to a busy street or powerlines. Conversely, creek lots, golf course lots, and greenbelt lots may have adjustments to increase the value. You’ll have to read the comments in the appraisal to see what’s being compared.

- Room Count and Square Footage (“Gross Living Area”) – Ensure that these are accurate and resemble the subject property.

- Net Adjustments – When this goes above 10% it means that some of the adjustments made may be getting too big. Also, see if any one comp is significantly more than the rest.

- Gross Adjustments – Same as the net adjustment above except these are typically up to 20%.

Look Beyond Numbers

Reviewing the appraisals and the data is the first step to fighting a low appraisal. The next is to look beyond the numbers. Dig deep and compare the comps you want to dismiss with the properties you want to insert.

Tell the Appraiser why the replacement is better. Be specific. Outline what adjustments can be made on the new home.

Good Example

Dear Appraiser, the neighborhood for Comp #2 is lower quality homes with prefab cabinets, carpet, and vinyl flooring, etc.. We would like to use 123 Main Street because it’s closer than Comp #3 and on the east side of Midway Road (like the subject property). Main Street has wood floors in all rooms except bedrooms, bathrooms, and laundry room. It has upgraded fixtures, etc.. It’s very similar to Comp #2. Thank you for your consideration.

Bad Example

Dear Appraiser, we would like an increase in value because the upgraded stone and brick for $5,300 on the front of the house was not considered. Also, we added the outdoor fireplace, installed a new gas grill, and installed a sound system throughout the house. Don’t be dumb and mean.

Good vs. Bad

Notice how the first example stated facts stating why Comp #2 was inferior to the replacement property. Example #2 doesn’t even offer anything different. Most of what was mentioned was an increase in “marketability” of the home but not in value. The good example is how you fight a low appraisal.

When things get close (i.e. within $5,000 of value) an Appraiser can look for common, smaller quality items to give value. A few examples are cooktops with vent hoods, upgraded crown modeling, different kinds of hardwoods, shutters and window treatment, mature trees, wrap around porches and balconies, hardscape, etc..

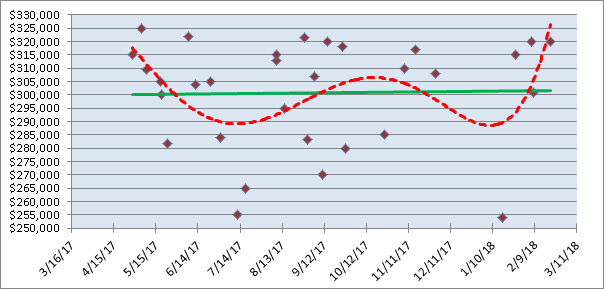

Look at Recent Trends

It is possible for an appraised value to be higher than all the “Adjusted Sale Price of Comparable”. This occurs in a hot market where values are aggressively trending higher. To prove this you would need to pull comps from 6, 12, 18, and even 24 months ago. Show how values have been trending higher with more recent sales.

Recent Trends with New Construction

If it’s a newly built community and no comps have yet closed then provide sales contracts showing how purchase prices are trending higher. The trick here is to dig deep and make sure the upward prices are truly indicative of the market. Often times new communities may offer discounted prices on the first few homes to get the sales started. They may also shift to more customizable options after the first round of specs and that will inherently increase the purchase price. Do your homework.

Tips For New Construction

With new construction, it’s prudent to verify that the Appraiser has all the upgrades to the home. Perhaps a recent change order wasn’t accounted for and may add value to the home. Moreover, ensure that all the neighborhood amenities were noted. Read the appraisal and see what was mentioned. While this may not make a huge dent in the value, every little bit helps.

It would be prudent to share your appraisal with the builder. They may have off-market comps (i.e. homes they sold that were not listed on MLS). Similarly, they may know another builder in the subdivision that has off-market comps.

What’s Next

Mark and the team can walk you through the entire home loan process and mortgage loan process. Call us with any questions and let us know how we can help.

Next: processing & credit approval

Previous: home appraisal process

Other Appraisal Related Articles

- Home appraisal process (great overview of the process)

- Don’t pay for the appraisal too soon

- How appraised value is determined (hint: it’s not price per square foot)

- Avoid appraisal pitfalls

- Appraised value vs. sales price – how to prepare for the worst

- How to fight a low appraisal